1k-5k employees

Fintech

How Saxo Bank cut time-to-market by 78% with a Governed Internal Platform

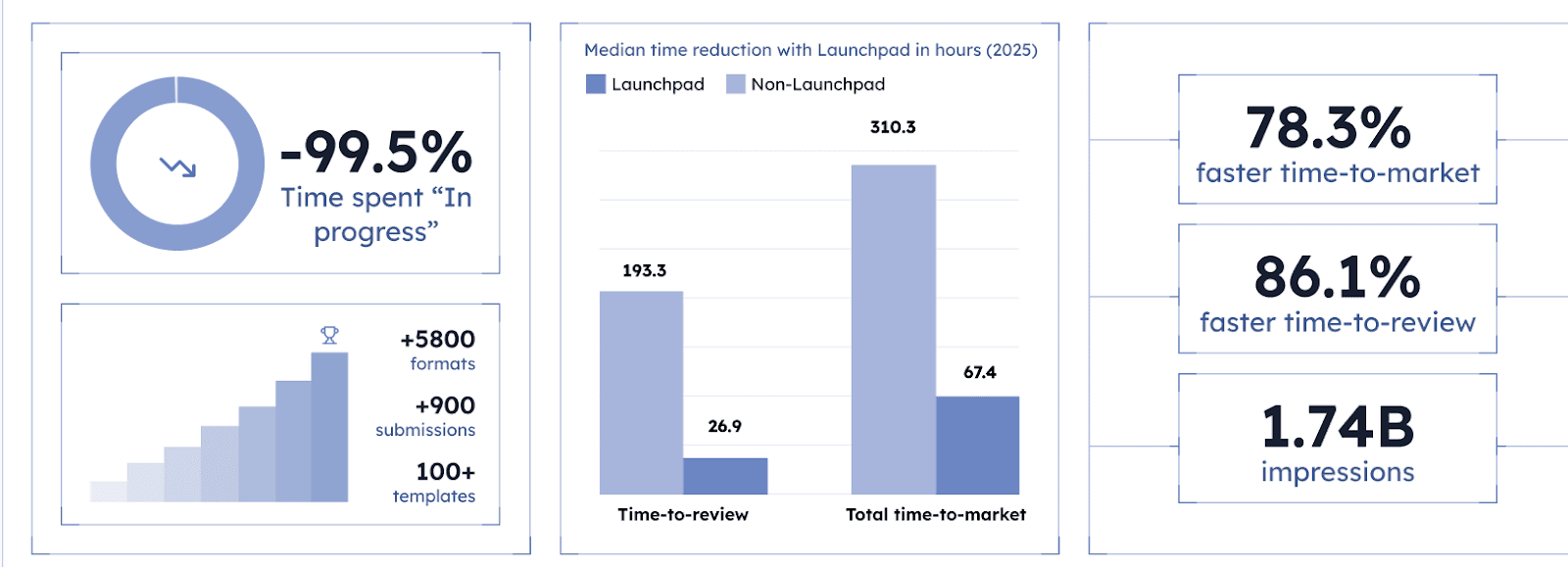

78.3% faster time-to market | 86.1% faster time-to-review | 1.74B impressions delivered |

|---|

Overview

As a global player in online trading and investing, Saxo Bank serves over 1.5 million clients and provides access to more than 71,000 different financial instruments. This volume of activity puts heavy pressure on creative operations: localizing, brand-checking, and publishing assets across 13 offices, 19 languages, and all key channels.

The constraint was not creativity or ambition. It was orchestration.

A lean in-house creative operations team managed hundreds of projects and produced thousands of formats each year. As business demands accelerated, expectations started to shift toward faster delivery, market-specific assets, and consistent brand quality at scale. The pressure on timelines intensified, and time-to-market often absorbed the impact.

Trying to scale creative operations on patchwork workflows and scattered tools creates the same problems engineering teams face without CI/CD: slow feedback, manual coordination, and errors that are avoidable.

What Saxo needed was a governed internal platform that could power high-velocity creative work without sacrificing brand control or creating any bottlenecks along the way.

That’s where Stackdrop came in.

The Solution

Stackdrop engineered a centralized internal platform that consolidated Saxo’s creative workflows into a single governed system.

Retool served as the low-code interface layer, supported by custom integrations that removed the manual handoffs and connected previously fragmented tools. Requests, approvals, asset management, and status tracking now move through one structured interface with full visibility and defined workflow controls.

The Challenge

Saxo’s creative teams operated at market speed, but the supporting systems were not designed to scale at quite the same pace.

New requests, briefs, approvals, and assets were distributed across multiple disconnected tools. Teams had to manually coordinate their workflows across chat threads, shared documents, and task systems. Brand governance was enforced outside of the workflow and relied on manual checks.

As volume increased, repetition grew, visibility declined, and critical launches were delayed. In financial markets, timing directly impacts performance, and delays carry measurable costs.

Saxo identified three core constraints:

Disconnected execution: IDs, assets, and tasks copied across tools

Offline brand control: Guidelines enforced outside the workflow

Low reusability: Processes were repeatedly rebuilt rather than standardized

Our Approach

Stackdrop applied a platform-based approach that was specifically designed to scale with operational complexity and volume.

For Saxo, this meant implementing Retool as the low-code interface layer and building tightly integrated systems that removed manual coordination, connected cross-functional workflows, and embedded governance directly into the creative process.

The objective was to establish a governed operating layer where work moves from intake to launch with a defined structure, end-to-end visibility, and controlled execution.

Implementation

The team began by analyzing the live submissions, approval flows, and workflow breakdowns across the entire creative lifecycle. Friction points were documented and translated into technical and architectural requirements.

Working closely with Saxo’s team, the full lifecycle was mapped in order to identify bottlenecks, duplication, and governance gaps. These insights informed the entire platform design.

Clickable prototypes were delivered in Retool within days, allowing for immediate testing and structured feedback. Comments were captured directly inside the product, and weekly review sessions prioritized development based on operational blockers.

"The collaboration between Stackdrop and our team, observing workflows, challenging legacy assumptions about best practices, led to new innovative solutions." - Jonas Elster Fjordgaard, Head of Creative Automation at Saxo Bank

The Launchpad Solution

Launchpad is a governed internal platform built on Retool that powers end-to-end creative production at Saxo Bank.

It brings together creators, designers, reviewers, and admins into a single shared interface where every campaign is tracked by market, with live status, clear ownership, and actionable next steps, all of which is directly visible on one dashboard.

Launchpad connects to the existing tech stack through custom integrations:

Zuuvi enables in-app previewing and adjustments of creative assets

Bynder is embedded for direct access to approved content from the DAM

Podio stays synced in both directions to align project tasks and deadlines

Governance is defined once and then it is applied system-wide through role-based workflows. Teams move smoothly through their paths, with brand standards automatically enforced as part of the process.

The architecture is built with the ability to flex with the changing tools and business needs. When Saxo adopted a new creative tool mid-year, Launchpad’s integration layer absorbed the shift seamlessly, which kept up the team’s momentum and ensured their workflow continued to flow.

On the analytics layer, Launchpad aggregates tickets and campaign data into structured reporting that surfaces operational insights:

Built-in analytics show where work slows down

Campaigns are grouped with NLP-based tagging to streamline reporting

Smart alerts flag any delays before escalation

The schema was created to scale, making it easy to add new channels, datasets, or AI-driven enhancements as the business requirements continue to grow and evolve.

“The Launchpad has allowed us to deliver creative assets faster, thereby reducing our time to market and cost. It has facilitated a self-service model and serves as a centralized hub for most of our paid assets.” - Kristin Sophusdottir - Marketing Operations Manager at Saxo Bank

What Saxo measured

Before Launchpad, Saxo established a clear objective: reduce time-to-market by 80% while enabling intraday self-service delivery for the majority of creative requests.

The initiative was aligned around three measurable outcomes:

Accelerated time-to-market

Lower creative production costs

Higher-quality creative output, consistently delivered at scale

Results

Launchpad delivered a measurable impact on speed and efficiency.

Saxo’s internal analysis reported a 78.3% reduction in median time to market, completely slashing the average project duration from 310 hours to just 67.

The review readiness phase dropped 86.1%, from 8.1 days to just 1.1 days, bringing delivery timelines closer to real-time responsiveness.

Within one year, the platform supported:

970 creative submissions processed in a single year

5,800 creative formats produced across social and display

1.75 billion impressions generated

Roughly 3 million clicks delivered through these campaigns

“This reallocation of resources enabled by the Launchpad contributes to improvements across time, costs, quality, and ultimately marketing performance.” - Jonas Elster Fjordgaard, Head of Creative Automation at Saxo Bank

What changed

Saxo’s creative operation now runs on a single governed platform layer.

Work is visible in real time, with structured workflows and embedded brand controls. The low-code interface allows for rapid iteration, while engineered integrations ensure system stability and data integrity.

The platform supports the addition of new channels, template updates, and tool changes without structural redesign.

Why it worked

The platform was designed around operational reality.

Governance is embedded directly within workflows. The integration layer preserves architectural flexibility. Low-code accelerates iteration, and engineered integrations ensure reliability as usage scales.

The result is a governed internal platform that combines adaptability at the interface with stability at the core.

Ready to Simplify and Accelerate?

Stackdrop designs governed, scalable internal platforms that reduce operational overhead, improve coordination across different functions, and increase time-to-market performance.

If you are operating at high volume and your teams are spending a disproportionate amount of time managing tools rather than delivering output, a governed internal platform can realign execution with business objectives.

Schedule a call to explore what this could look like in your environment.